Discover the benefits of investing in style

If you’ve been reading the financial press, you’ve likely read about a shift in sentiment within global equity markets. Financial commentators are noting how investors are selling growth-oriented equities in favor of value-oriented stocks since the announcement of a successful vaccine. What makes this change noteworthy is that value stocks have been out of favour for over a decade as growth equities led the way.

For those unfamiliar with the terms “growth” and “value” and how they apply to stock investing, you may be wondering what this shift means and how it might affect your investments. Growth and value refer to two popular investment methodologies – or styles – that investors employ when selecting stocks. A deeper understanding of these investment styles can give you some insight into what’s driving stock markets and what investment managers consider when selecting stocks for your portfolio.

Value vs. Growth - Two investing styles explained

Let’s start with a few definitions:

The pros and cons of each investing style

Growth-Style Investing

Pros:

- Invest in great companies that are growing fast and generating stronger than market returns

- Opportunity to invest in exciting new companies, such as technology innovators or those that are rapidly driving changes in consumer behaviour

- Can benefit from companies that have made a positive change in their business strategy or their leadership

Cons:

- Equity prices can be volatile as risks tend to be higher

- Expected price gains may not materialize if growth expectations don’t pan out or business fundamentals suddenly change.

Value-Style Investing

Pros:

- Invest in great companies for less than its real value

- Ignores market noise – focuses on fundamental value and long-term prospects of a business

- Can experience steady, consistent gains in the long run

- Short-term price volatility is not a cause for concern as long as a company’s business fundamentals are strong

- Often can earn dividends

Cons:

- Requires long-term patience to benefit from price gains

- Price gains may not meet long-term expectations

- Hard to tell if a falling price trend will continue

Which is better – growth or value?

So how do you decide which investment style is best for you? Understanding how each investment style has performed over time can help. More than that, however, discovering why it can be beneficial to integrate both styles into your long-term investment strategy can not only help you stay invested it can also help smooth out your investment returns over time.

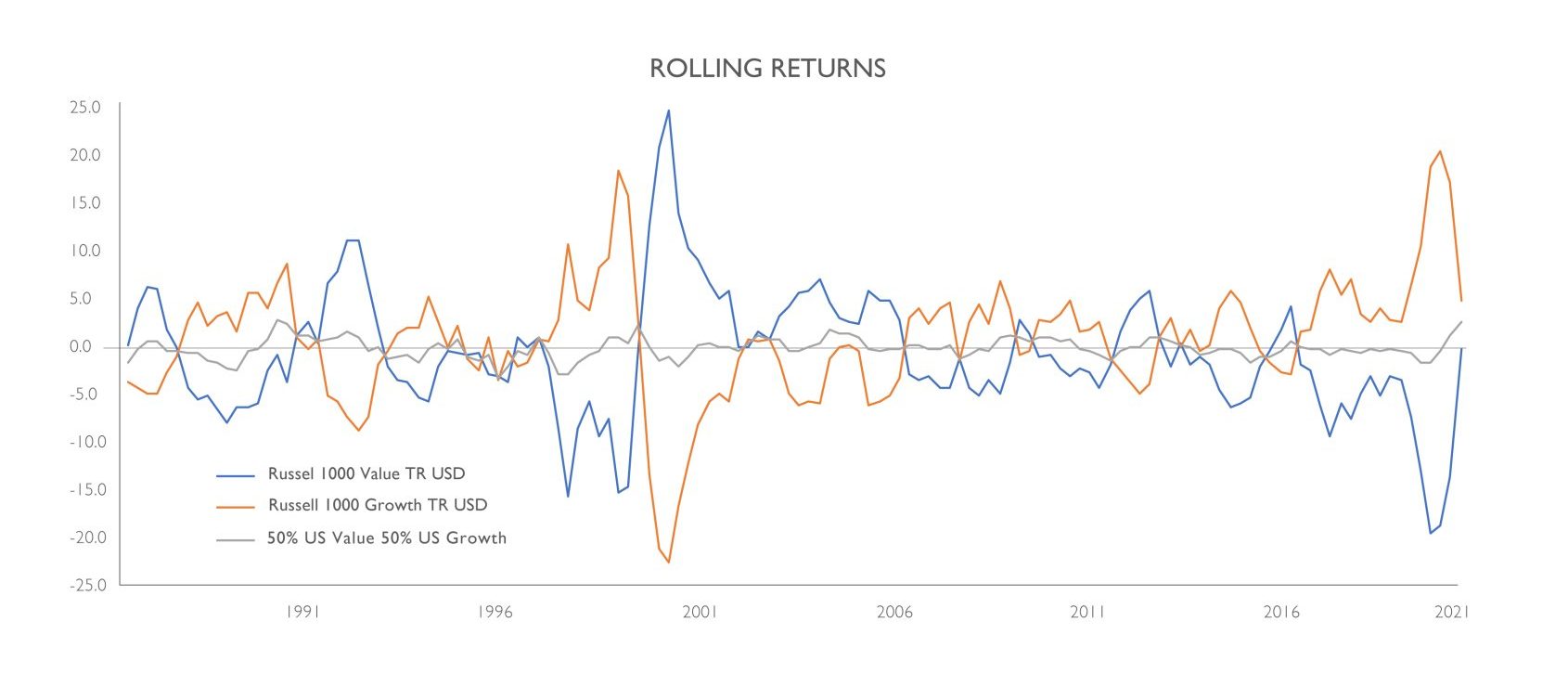

Illustration 1 shows how stocks that conform to either a growth or value orientation have performed since 1987. It shows that there are extended periods when one style outperformed the other. While there can be many reasons for this, the key takeaway is that it can be challenging to predict when market sentiment will shift from growth to value and back again.

Growth and Value – A history of changing leadership

Take 2020, for example. Few could have predicted the emergence of the COVID-19 virus and how it would affect the global economy. When news spread that the virus had become a global pandemic, stocks suffered considerable losses as investors turned to protect capital. Investors quickly found their footing and began investing in stocks of companies like Zoom Video, Amazon, and Netflix that were benefitting due to changes in consumer behavior. The result was that 2020 was a good year for select growth stocks, an outcome few could have predicted at the beginning of the year.

In late 2020, market sentiment shifted to favour stocks with a value orientation. The driving force behind this change was news on vaccine development. Forward-looking investors realized that the end of the pandemic was on the horizon and bought companies whose share prices would benefit from the re-opening of the economy when growth would be abundant. The result was that the performance of value-oriented equities surpassed growth equities in February of 2021 for the best relative showing in any month since 2001.[1]

This example illustrates just how difficult it can be to time the market. No one could have foreseen the emergence of COVID-19 virus and the economic havoc it would cause, nor could they have predicted the record-setting pace of vaccine development that followed. This inability to accurately predict changes in market sentiment is the primary reason why many professional investors recommend a style-neutral approach to equity investing.

Why style neutral

There are several reasons why we recommend a style neutral approach to equity investing:

- Just as it’s impossible to time the asset class that will outperform in any given year, we believe it’s impossible to time the markets for style outperformance.

- It improves the overall diversification strategy for a portfolio.

- Investors who attain consistent returns tend to stay invested over time.

To illustrate the benefits of a style-neutral approach, Table 1 compares the performance of three indices: the Russell 1000 Growth, Russell 1000 Value, and a 50/50 blend of both over recent periods. If you were invested exclusively in value stocks, there would be years where you would have been deeply disappointed by your returns relative to that of a growth-oriented investor.

Table 1:

Source: Morningstar Direct as of April 30, 2021.

When we look at the performance of the style neutral 50/50 approach, we see how it provided a more consistent and competitive rate of return. We know from experience that investors who earn consistent rates of return tend to stay invested and benefit from market growth. Diversifying by investment style allows you to avoid the pitfalls and potential frustration of guessing which style will outperform in the future while ensuring a smoother, less volatile path to achieving your financial goals.

Choosing one style over the other

Whether you decide to take a more style-neutral approach to investing or favour a growth or value-oriented style will likely depend on your financial goals and investment philosophy.

We’re here to walk you through the strategies that best align to your needs and objectives, including your investment horizon and tolerance for market volatility.

[1] Source: Forbes. Growth Stocks Vs. Value Stocks: The Untold Reality. Robert Zucarro, April 26, 2021.