Don’t put all your eggs in one basket. It’s a common expression and a sound principle that can help mitigate risk when investing in financial markets. Yet how many baskets do you actually need?

In this article, we dig deeper into this common wisdom to explore how you can achieve diversification benefits with an investment approach focused on a professional portfolio manager’s short-list of their best ‘high conviction’ ideas. In other words, putting your eggs in a small number of the best baskets available.

Many affluent Canadians are already taking this approach, so let’s examine how you can benefit from a concentrated portfolio.

Why is diversification important for your investments?

Diversification typically refers to the strategies investors employ to reduce the risks associated with investing in a single security.

In the case of investment in equities, investors tend to spread their capital across different companies, economic sectors, and geographical regions to mitigate the impact of a loss to the portfolio if one of the underlying companies fails to meet expectations.

If your portfolio includes securities with low correlation between how they each perform, it will tend to provide you with a smoother ride and help you remain on track towards achieving your financial goals.

Is it possible to be too diversified?

The short answer is yes. The simple act of spreading your investment across too many options and without an appropriate strategy can be inefficient and even undermine your long-term returns.

Studies have shown that additional diversification, when carried out carelessly, provides little to no benefit to the average investor past a certain point, and it may even dilute investment returns over time.

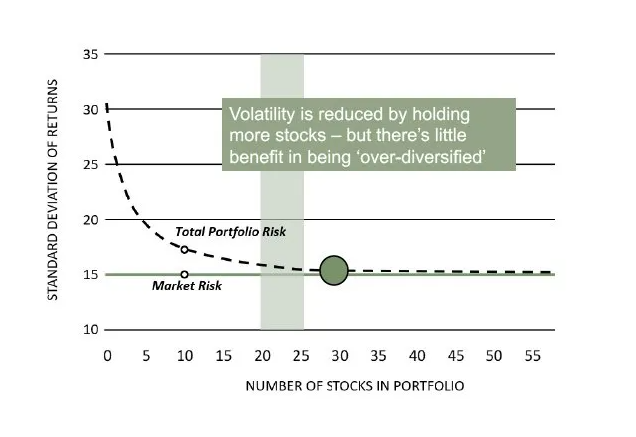

Many investors assume that adding more and more stocks to a portfolio alone can help reduce investment risk. Yet studies show that once you have an appropriate set of stocks in a given mandate, you gain little in the way of additional benefits from added diversification (illustration 1)[1].

There are several potential downsides to being over-diversified, including:

- Overlapping objectives. Investing in portfolios containing hundreds of individual securities with the aim of diversifying can be counterproductive if their investment objectives overlap.

- Higher cost. Investing in more than one mutual fund with a similar mandate can needlessly increase investment costs.

- Increased complexity. Exposure to thousands of underlying securities offers little in the way of additional diversification benefits while potentially increasing complexity and diluting your investment returns.

Why concentrated diversification works

Professional portfolio managers are often specialists in a specific style of investing and use their considerable skills and research to invest in a shortlist of stocks in which they have high levels of confidence.

Investors with smaller accounts typically do not have access to this high-conviction portfolio strategy, which may have only 25–30 stocks chosen from a universe of thousands of options.

Studies prove[1] that despite investing in a small selection of stocks this way, effective portfolio diversification can still be achieved since the individual securities can be diversified by economic sector, geographic region, investment style and market capitalization – all of which are critical components of a fully diversified investment strategy.

This approach offers two key benefits:

- Transparency - A concentrated approach helps to make a portfolio more understandable and less of a ‘black box’ with the investor uncertain about which companies they hold.

- Simplification - A portfolio with many moving parts and complex or overlapping strategies can leave investors unsure of which investments are contributing or detracting from the overall performance.

This same approach can also be applied to fixed-income investing. Rather than investing in hundreds or even thousands of bonds, affluent investors take a more concentrated approach, investing in a shortlist of carefully selected bonds with rolling maturities. A professional manager oversees this bond ladder approach, which can help offset the negative effects of rising interest rates while protecting capital over time.

Is a concentrated portfolio right for you?

The choice of whether to invest with a broad diversification approach or a more concentrated approach is a personal one that should be based on your preferences, comfort level, and financial objectives.

If your current portfolio holds multiple investment solutions and you’re unsure how they complement each other to help achieve your financial goals, perhaps it’s time to ask for a comprehensive portfolio review. We can determine if you may benefit from a concentrated approach with increased clarity regarding the individual holdings[2].

When investing, you never want to put all your eggs in one basket. Yet sometimes all you need is a few of the best baskets to achieve your investment goals and have a more rewarding experience doing so.

[1] Journal of Financial and Quantitative Analysis; Meir Statman,1987. Investment Analysis and Management; F. Reilly and K. Brown, 2011.

[2] If you are a seasoned investor with a larger account, be sure to discuss the advantages of taking a more concentrated approach to investing through an investment solution like IPC Private Wealth Visio Pools. Visio Pools provide access to concentrated portfolios of the best investment ideas from top-ranked asset managers carefully selected for their specific areas of expertise. The result is portfolios that are lower cost, easier to monitor and understand, and optimized to achieve your financial objectives.

Investment Planning Counsel