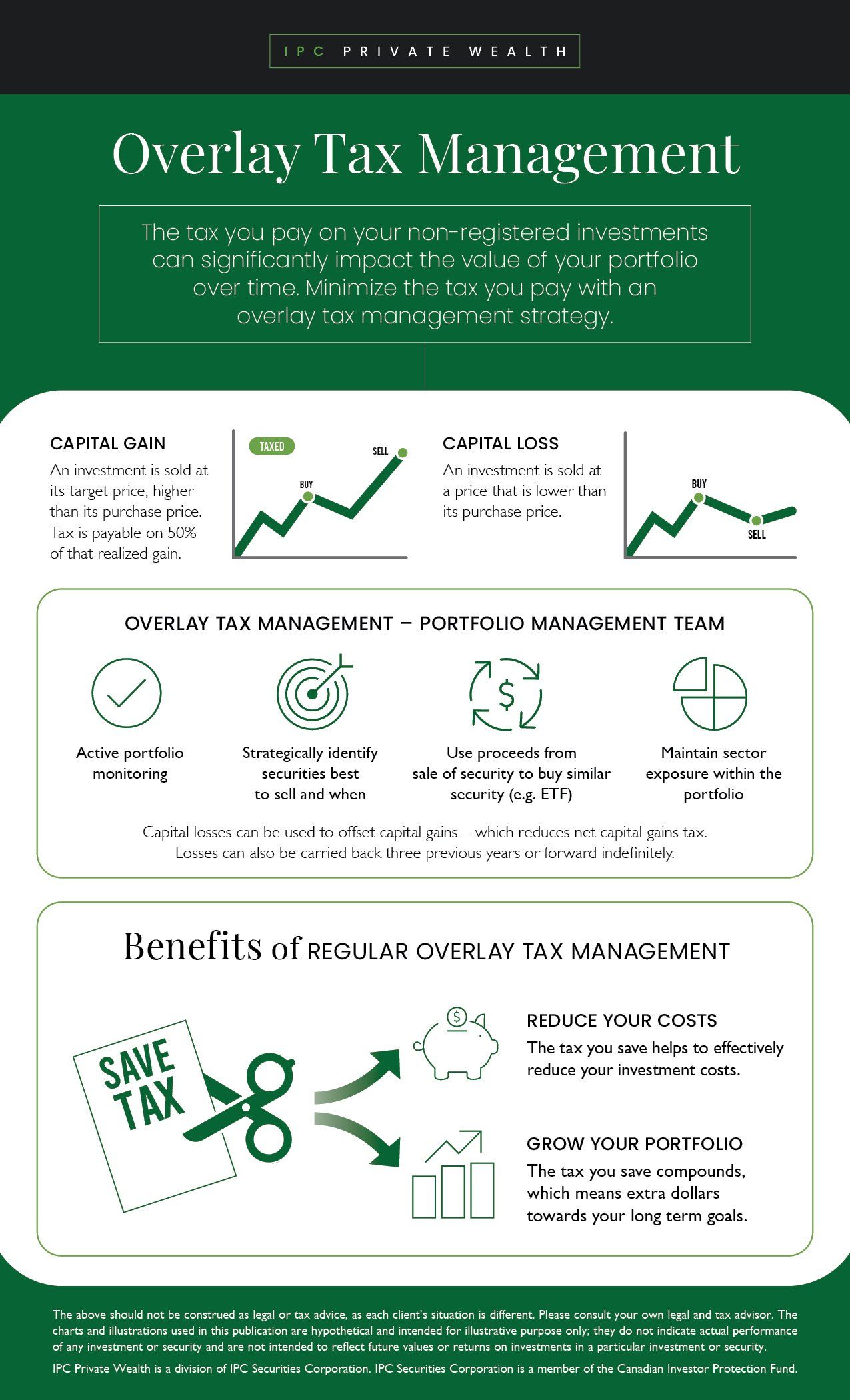

For most investors and portfolio managers, tax-loss selling – or tax-loss harvesting – is typically near the top of the list of year-end tax strategies. You sell a non-registered investment that’s worth less than its original cost, and you apply the resulting capital loss against capital gains. The net result is a lower tax bill.

But you don’t need to wait until the end of the year to take advantage of this tax strategy. At IPC Private Wealth, for example, our Portfolio Management Team practices tax-loss harvesting year-round on behalf of our investors. Investments are monitored regularly, and if a tax-loss harvesting opportunity that’s beneficial to the investor is identified, the team will take advantage of it. Harvesting capital losses year-round provides investors with the opportunity to use them to offset capital gain either in the current year, a future year, or from the three previous tax years.

Repurchasing a Promising Investment

Sometimes an investment is an ideal candidate for tax-loss harvesting but remains a holding our investment specialist continues to believe in. For example, a security may have lost value because the sector it belongs to is experiencing a downturn, which is expected to be temporary. This calls for a hands-on monitoring approach to benefit the investor through tax loss harvesting. In instances like this, we will sell the investment to realize the capital loss, but after a statutory period of time (30 days), we will repurchase it. In order to maintain the underlying characteristics of your portfolio during the ‘harvesting’ period, we will typically hold a sector ETF that is representative of the security that we have sold. On occasion, if the investment specialist’s view of that original holding changes within the 30-day ‘harvesting’ period, and they recommend disposal of that original security in favour of another security with greater potential upside, we will simply re-purchase the new recommendation.

How You Come Out Ahead

Any tax-loss transactions we conduct throughout the year benefit you when you file your tax return. You apply any capital losses against capital gains from the same tax year, paying less tax overall. You can magnify these tax savings by investing the money you save back into your portfolio, where they’ll become investment assets that compound over time.

It is possible for an individual investor or financial professional to practice year-round tax-loss harvesting. But you need the expertise to know when to sell and the time to actively monitor a portfolio for opportunities.

To find out about year-round tax-loss harvesting, give us a call.

Investment Planning Counsel