Blog Layout

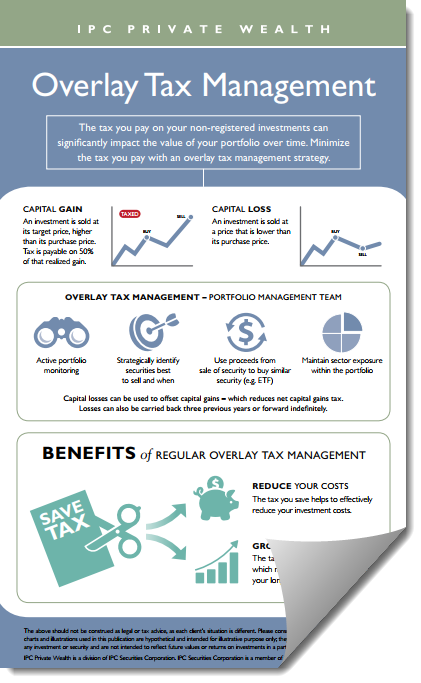

Taxation on non-registered investments can significantly impact the value of your portfolio over time. So it’s always wise to minimize the tax you pay when you can.

One strategy to achieve this is through overlay tax management. For most investors and portfolio managers, this strategy is typically near the top of the list of year-end portfolio management activities. But you don’t need to wait until the end of the year to do this.

This infographic explains how this strategy works and how you can minimize the tax you pay over the long term.

Talk to your Advisor or one of our Advisors on how you can increase the value of your portfolio and start making this strategy work for you today.

© 2025

Investment Planning Counsel