As a portfolio service, we are impartial to your preferences for investment style, asset class allocation, or geographic market exposure. We wrap investments with a selection of portfolio management service options that you can opt to use based on your desired investing or cost preferences.

What you get:

- A disciplined method for portfolio design and construction.

- An impartial approach to research, select and monitor every investment specialist on your portfolio.

- Access to multiple investment types, including individual securities, exchange-traded funds, mutual funds, pools, alternatives, separately managed accounts, and unified managed accounts.

- An objective way to combine investment specialists within your portfolio and target total returns.

- Careful portfolio oversight to keep your portfolio aligned to your goals.

- Regular automated rebalancing to sell high and buy low. This removes emotional stress from the decisionmaking process.

- Tax management to capitalize losses and minimize the taxable implications on your portfolio.

- Currency management to reduce the effects of exchange rate fluctuations and smooth out your longterm returns potential.

- Risk management strategies to protect your investments from market volatility.

What you don’t get:

- Ultra-aggressive investment options. We focus on managing risk to protect capital as needed.

- We do not actively time the market. Instead, we invest for the longterm.

- We are not product-focused, which means we are not a single-style, single-market wealth manager. We design well-diversified solutions to meet your investment needs.

- We don’t focus on specific market niches or specialty investment classes. Instead, we concentrate on the right combination of various asset classes to provide the necessary amount of capital growth and capital preservation for investors.

- We do not manage assets to meet arbitrary industry category definitions – i.e. to be “the best portfolio in the Canadian equity balanced category”. We focus on diversified asset allocation models, which means your portfolio may include a Canadian equity mandate, but it will also have allocations to other asset classes to better manage growth and preservation opportunities overall.

Not all the upside, not all the downside

Depending on how a portfolio is structured, there will be times during market cycles when it will underperform its peers within broad industry categories (e.g. the Global Balanced category).

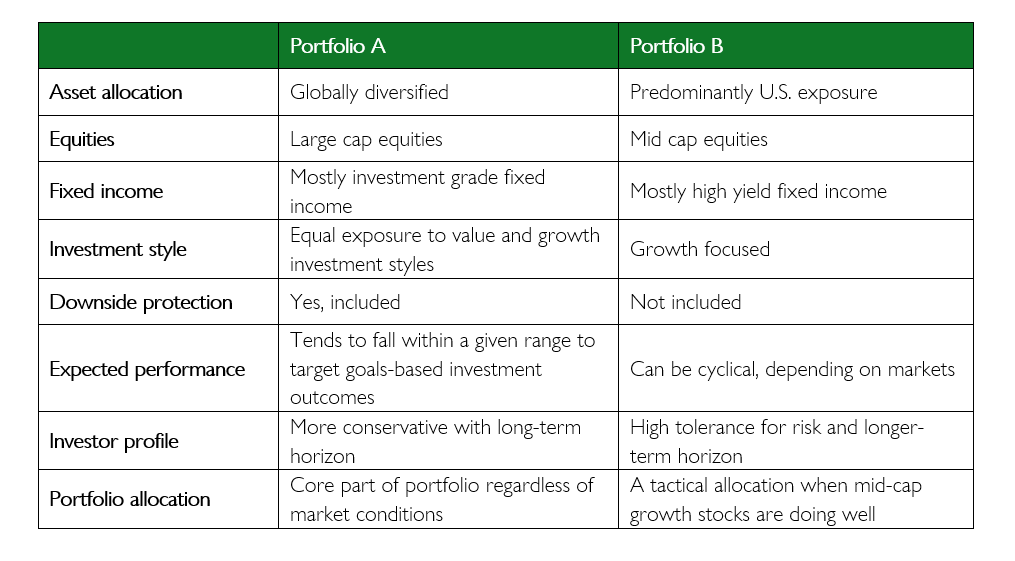

When making industry category comparisons, it is crucial to evaluate the asset allocation models of the portfolios. You will likely find that the portfolios within a category are not apples to apples comparisons. For example, the two portfolios below are both classified as Global Neutral Balanced, but as you can see, they have little in common.

In short, when there are periods of strong market growth, an increased focus on risk management can lead to underperformance, relative to the market. However, it’s that same focus on risk management that helps the portfolio outperform during periods of sustained market downturns, to preserve capital for investors. There will always be a trade-off between the level of risk an investor takes on for the reward they seek.

Our portfolio services' investment philosophy, which is multi-strategy, multi-manager with a focus on downside protection, and capital preservation tends to appeal more to investors who may be risk-averse, close to retirement, or already in retirement. These are typically investors who do not want to take large risks with their portfolios.

For more information on IPC's Portfolio Services, read What Makes Us Different

Counsel Portfolio Services | IPC Private Wealth

Click Here to Read Our Forward Looking Statements Disclaimer

Investment Planning Counsel