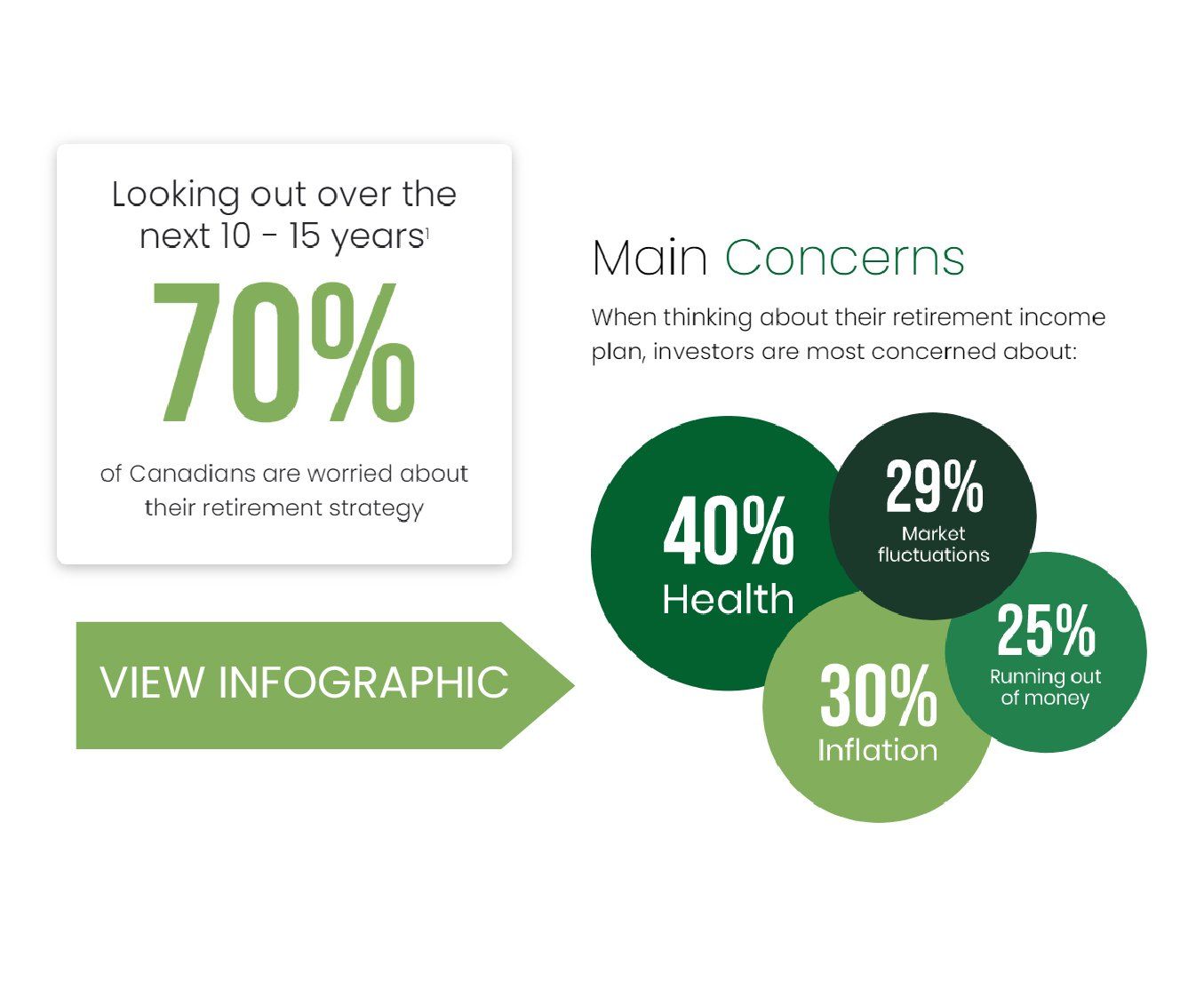

In a recent survey, we found that 70% of those polled were concerned about their retirement strategy.

From generating enough income to offset healthcare expenses to managing inflationary pressures and market fluctuations, Canadians have a number of concerns when looking out over the next 15 years.

To help provide Canadians with a greater sense of certainty about their retirement plans, we’re highlighting the benefits of professional financial advice. With challenges ranging from historically low -interest rates to inflation and market volatility, determining how to maximize your retirement income in the safest, most effective, and tax-efficient way possible in today’s economy requires an experienced hand and a personalized plan.

Your retirement is too important to leave to chance. With over 90% of survey respondents confirming that professional financial advice has had a positive impact on achieving their life goals, why not start your conversation with an advisor on how to maximize your retirement income with more confidence.

Learn more about the various factors that go into a comprehensive retirement plan in this infographic.

Investment Planning Counsel