There is an oft-used expression in our industry that markets go down the elevator and up the stairs. However, this year, one of the sharpest and swiftest market declines in history has been followed by one of the swiftest and sharpest climbs. This is puzzling both investment managers and central banks like the U.S. Federal Reserve, who view the backdrop of the economy in stark contrast to financial markets. So, let’s explore where we are today and what paths might unfold before us.

The global economy is starting to recover from the deepest and fastest recession of modern times as the global lockdown to enforce physical distancing ground economic activity mostly to a halt. It remains to be seen whether this will be the shortest recession on record, as a near-term bounce in economic activity in response to the easing of lockdown measures takes shape. However, we expect the recovery to be long and arduous for the following reasons:

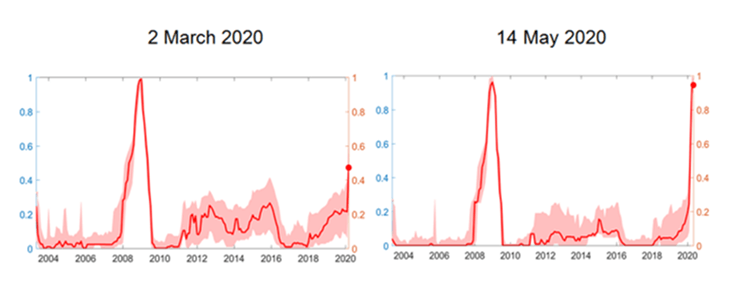

1. Global economies were already exhibiting weak economic growth prior to the pandemic and subsequent lockdowns. The ECB just released an interesting paper, which considers the global weakness now and what it means for a recovery later. This is how the ECB paper puts it: “The indicator already pointed to clear signs of economic weakness as early as 2 March 2020. This weakness was confirmed by official statistics on 4 May 2020, when Q1 GDP data for most countries were released. The risks of a downturn were in play well before the pandemic.” In other words, the pandemic only sped up the pace of an economic slowdown that was already in progress.

Global Weakness Index

Note: The figure shows the Global Weakness Index, which is constructed as a weighted average of the probabilities of the low economic activity regime across economies. It is weighted by the size of the corresponding economies. The red area represents the credible set based on the 16th and 84th percentiles of the posterior distribution.

Source: European Central Bank

The pandemic only sped up the pace of an

economic slowdown that was already in progress.

2. Social distancing will be necessary and likely stay in place until an effective medical treatment for the virus is widely available. This means many industries will not be able to ramp up to pre-crisis levels anytime soon.

3. It’s been commented to me that there is no treatment for SARS, but the world moved on from that virus, so why not COVID-19? Despite some similarities to COVID-19, SARS proved much easier to contain and spread less broadly. This latest virus is more persistent and much harder to detect. And, because the entire globe is infected, economies are less likely to revive fully until their economic partners have recovered as well.

4. Global and national supply chains will remain impaired for some time because reopening will be uneven across countries, regions, and sectors. Labour and capital needing to reallocate from losing to winning sectors and companies is a time-consuming process that will be highly disruptive and may even be hampered by fiscal policies that keeps these “zombie” firms in business.

5. A debt overhang among governments, households and corporations due to the recession will likely weigh on consumer and investment spending for the foreseeable future.

As you can see, the road back is uncertain and the recovery will likely have more nuisances and take longer than some of the sharp recoveries of the past. The main source of uncertainty and, hence, the key swing factor for the economic outlook, lies outside the reach of monetary or fiscal policies: a rapidly evolving COVID-19 pandemic that could easily push the economy into better or worse paths.

The Good

The good scenario sees a rapid economic recovery come to pass if the massive worldwide scientific race to develop a vaccine or other medical treatments produces early and scalable results, therefore, reducing the need for social distancing faster than expected. More than 100 vaccines are currently in development across the world, with 10 already in human trials. The caveat is the unknown. It’s unknown if any of these will be successful treatments or what degree of protection these vaccines will provide. Will the protection be for life, three years or six months? So, at this stage, even for the experts, it is virtually impossible to make confident predictions on when effective medical cures will be available.

The Bad

The bad economic scenario of a much slower recovery or even a double-dip recession would most likely result from strong and widespread second waves of COVID-19 infections that lead to renewed government-mandated or voluntary interruptions of economic activity. History and common sense suggest that second pandemic waves are the norm rather than the exception. Parts of Asia and, more recently, some regions in Europe and the U.S. have already seen a re-acceleration of infections as mobility and activity have picked up. How widespread and strong such second waves will be, remains a guessing game.

The Ugly

Needless to say, a double-dip in economic activity caused by significant second waves could easily turn a bad scenario into an ugly one. Cascading bankruptcies of many small and medium size companies that have been kept afloat with emergency liquidity would become more likely, and many temporary layoffs would turn into permanent job losses.

While the health situation is currently the main swing factor for the economic outlook, there are of course other factors that pose risks to our baseline scenario, including trade tensions between the U.S. and China in the run-up to the American elections in November. A flare-up of the trade war could easily reduce business confidence, tighten financial conditions and derail an already fragile economic recovery.

The V- Shaped Market Recovery

If the economic recovery is likely to take a long time, uncertainty is high and risks are skewed to the downside - views that most economic forecasters seem to share - then why have risk assets rallied so strongly off the March lows?

The most plausible explanation seems to be that investors find it notoriously difficult to price “uncertainty” and tend to just ignore it, taking their cues from more familiar and easily observable factors such as the swift and large policy responses by central banks and governments. Behavioural experiments show that high levels of uncertainty favours herding behaviors. In other words, during periods of high uncertainty, investors exhibit similar behaviours and actions. What is unknown is whether investors consciously copy the decisions of others or whether, when faced with similar information and problems, they make the same decisions without necessarily observing each other.

With monetary and fiscal policies playing such a crucial role in cushioning the effects of the “lockdown recession” and in propping up asset prices, here is what we concluded about the policy outlook and its likely implications.

- With the economic recession likely to remain longer term, and central banks showing their willingness to keep widening their safety net, if needed, risk assets could continue to outperform. That is what has happened recently, as the rally in almost all risk assets has been universal in the face of dire economic data and the fact that COVID-19 has not yet been fully contained in most countries.

- Higher public sector debt levels and larger budget deficits for longer will require ongoing central bank support. Large-scale debt monetization, explicit or implicit yield curve control, and zero or negative policy rates will be lasting legacies of the COVID-19 crisis, implying nominal and real interest rates will be lower for longer.

- Last, but not least, while near-term inflation pressures are likely to be low, the prospect of continued fiscal activism supported by debt monetization and repressed interest rates suggests to us that longer-term inflation risks are tilted to the upside. Therefore, just like economic activity, inflation and inflation expectations may be in for a long climb from depressed levels.

What This Means for Our Portfolios?

Over the last several months, we have made changes to our portfolios to address the market’s triple threat of low interest rates, high asset valuation and low economic growth. The global pandemic has only compounded the difficulty of achieving a long-term 6 - 7% return in our balanced portfolios. More detail is required on this topic and will be the subject of a future letter, however, in short, we are very aware of the long-term challenges facing all investment portfolios.

In terms of the shorter-term outlook, challenges and how we are managing these risks, we remain quite cautious and are not inclined to take on significant portfolio bets in order to try and achieve a potentially higher rate of return. We believe that fiscal and monetary policies will continue to support markets. However, it appears to us that further gains from a scenario where the path to recovery is better than expected doesn’t fully compensate the risks of decline from our baseline view.

We have reallocated from emerging market (EM) bonds to U.S. high yield bonds for three reasons:

- The March sell-off created an opportunity in U.S. high yield bonds. We believed that the illiquidity in markets overstated the default risk. Given the more conservative nature of our high yield mandate, it was a good opportunity to take advantage of those dislocations

- For the near future, U.S. high yield bonds will be supported by central bank activity in the open market buying both investment grade and high yield bonds

- EM assets will be subject to significant dislocations, although this could perhaps provide an opportunity in the future for us to rotate back into EMs.

Given our base view of the risks, we do not believe that we should materially increase portfolio risk. At this time, we are not increasing our exposure to equities, especially to small cap, as we believe that it is still too early in the recovery for those assets to outperform. However, we are “letting winners run” and as equities, particularly U.S. growth equities, continue to outperform, we are not trimming or rebalancing that exposure.

We remain quite cautious and are not inclined to take on significant portfolio bets to try and achieve a potentially higher rate of return.

Last year, we diversified our equity strategies to include multi-factor strategies. I realize we have a great deal of work to do to further explain the benefit of those strategies, since investors continue to believe that traditional stock selection is the primary driver of an investment portfolio’s returns. To be clear, the long-term evidence is that market exposure (Beta) and risk factors are the primary drivers, but we can certainly delve more into that in the future. The introduction of the multi-factor strategies has improved the risk exposures of our portfolios, reducing the imbalances that existed. It has been only eight months, and I would be insincere to attest that the results of this change were statistically better than the previous 50/50 allocation to value/growth styles. However, I can say that there has been no significant material difference over this short period.

Earlier this year, we moved our regional equity allocations closer to our neutral benchmark weighting to reflect the continued slowing economic growth and lack of visible catalysts that would cause a significant divergence between domestic, U.S., International, real estate and small cap equities. That change was beneficial, as the increase in U.S. assets was an additional hedge during the downturn, particularly given the U.S. fiscal and policy responses that were swift and decisive. No further changes to the regional equity allocations are planned at the moment.

With respect to our tail risk strategies, they continue to operate as intended. I will cover this in more detail in my next letter. As a quick reminder, a short, rapid decline is preferable to a long drawn out one because of the opportunity cost of not growing your assets for a long time. Our defensive strategies are not geared to protect against ‘V-shaped’ market declines and recoveries (think 1987 and this year). Although they are uncomfortable to live through, they are short-lived and, for an investor who does not panic and sell, the impact will be minimal to their long-term goals. More on that next time. In short, given the risks outlined above, we are maintaining our defensive strategies in the portfolios.

The pandemic only sped up the pace of an

economic slowdown that was already in progress.

Final Thoughts

An assessment of the current economic backdrop and financial market conditions leads me to conclude that the significant rally that we have witnessed has been built on optimism and has overlooked potential negatives. It is being driven largely by central bank injections of liquidity and by fiscal stimulus with the intent of providing a bridge to a fundamental recovery. Markets are assuming that the path to recovery will be swift and free of highly negative second order consequences. Given where valuations are for risk assets, there is no room for potential stumbles along the path to recovery. We do not know for certain what path the economy or financial markets will take, only that we need to be forward-looking rather than investing by looking in the rear-view mirror.

The pandemic only sped up the pace of an

economic slowdown that was already in progress.

Our portfolios are designed to participate in all market conditions, balancing potential risks with expected returns. Whether the next decade’s investment environment will be a continuation of the previous one – with abnormally low interest rates, moderate growth and increasing globalization and automation – or look entirely different, our aim is to participate and provide a reasonable return for the risks taken while avoiding unattractive risk/reward bets. As the ancient Greek philosopher Heraclitus, who lived around 500 BC, said: “The only constant in life is change.” He could just as easily have said that today.

Corrado Tiralongo

Chief Investment Officer

Investment Planning Counsel