When interest rates go up, most people are worried about the impact on their mortgage.

At IPC, we’re also concerned about what happens to bond prices. Why is that? That’s because the part of your portfolio which is held in bonds is at risk due to price decreases when interest rates rise.

Here's How It Works:

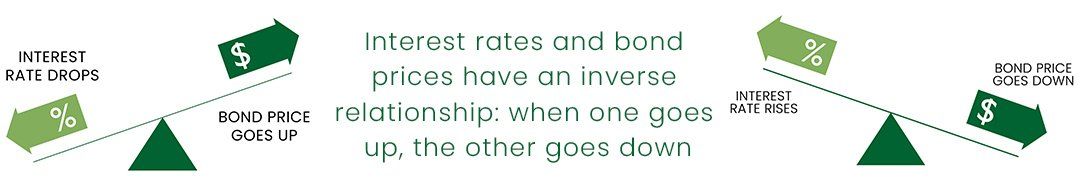

When new bonds are issued, they typically have an interest rate set at or close to the current market interest rate at that time. As market interest rates change, an existing bond’s interest rate – which is fixed – becomes more or less attractive to investors, who are then willing to pay more or less for the bond itself. This is known as interest rate risk.

How Can We Add Value?

Our Portfolio Management Team works to protect you from interest rate risk by blending together diversified fixed income strategies into one cohesive mandate.

Managing credit risk

Canadian long-term government and corporate bonds provide stable payouts. When rates rise, they are susceptible to decreasing prices.

Diversification

Global corporate and government bonds, as well as emerging market bonds, may provide higher payouts than Canadian bonds and are not impacted by Canadian rate hikes.

Managing long term risk

Short-term bonds are impacted less than long-term bonds by interest rate increases.

Enhanced yield

High yielding North American corporate bonds provide higher than the typical bond payout rates and are affected less by interest rate increases.

Together these varied sources lessen interest rate risk in your portfolio and provide a reliable, sustainable income stream. Interest rate protection is just one of many highly specialized services our Portfolio Management Team provides to help support your financial plan.

Contact your Advisor to learn more.

Investment Planning Counsel