Inflation in Canada, the U.S., and around the world has been increasing at its fastest rate in over 40 years.

Even the most recent numbers show the U.S. Consumer Price Index (CPI) at 8.2%, and 6.9% in Canada, down only slightly from their previous highs. In the European Union, prices are rising faster than at any time since the euro currency was introduced. Even Japan, where prices have been perennially depressed, has experienced the green shoots of inflation. Among major economies, only China has a lower inflation rate today than in early 2020.

With the covid-induced supply chain shortages and consumer demand coming back stronger than ever, the demand/supply imbalance has created significant inflationary pressures. During the work-from-home era, millions of Canadians shifted their spending from restaurants and movie theaters to the purchase of “goods.” Buying all those goods drove up prices as suppliers struggled to keep pace with demand. Over the past few months, although goods prices have been slowly coming down, the stickier part of inflation i.e., Owners Equivalent Rent, wages, etc. has started to pick up raising the concern that the only way to bring down inflation is through a recession.

With inflation rates higher than in any period since the 1980s, investors and retirees are worried about how to protect their portfolios. Although global tensions in Ukraine have exacerbated an already difficult period for consumers, we still believe that many of these price pressures should prove temporary, albeit with a lengthened timeline that will extend beyond 2022. The IPC Portfolio Management team has been analyzing price moves carefully and positioning our portfolios to provide better outcomes.

Have traditional inflation hedges been effective?

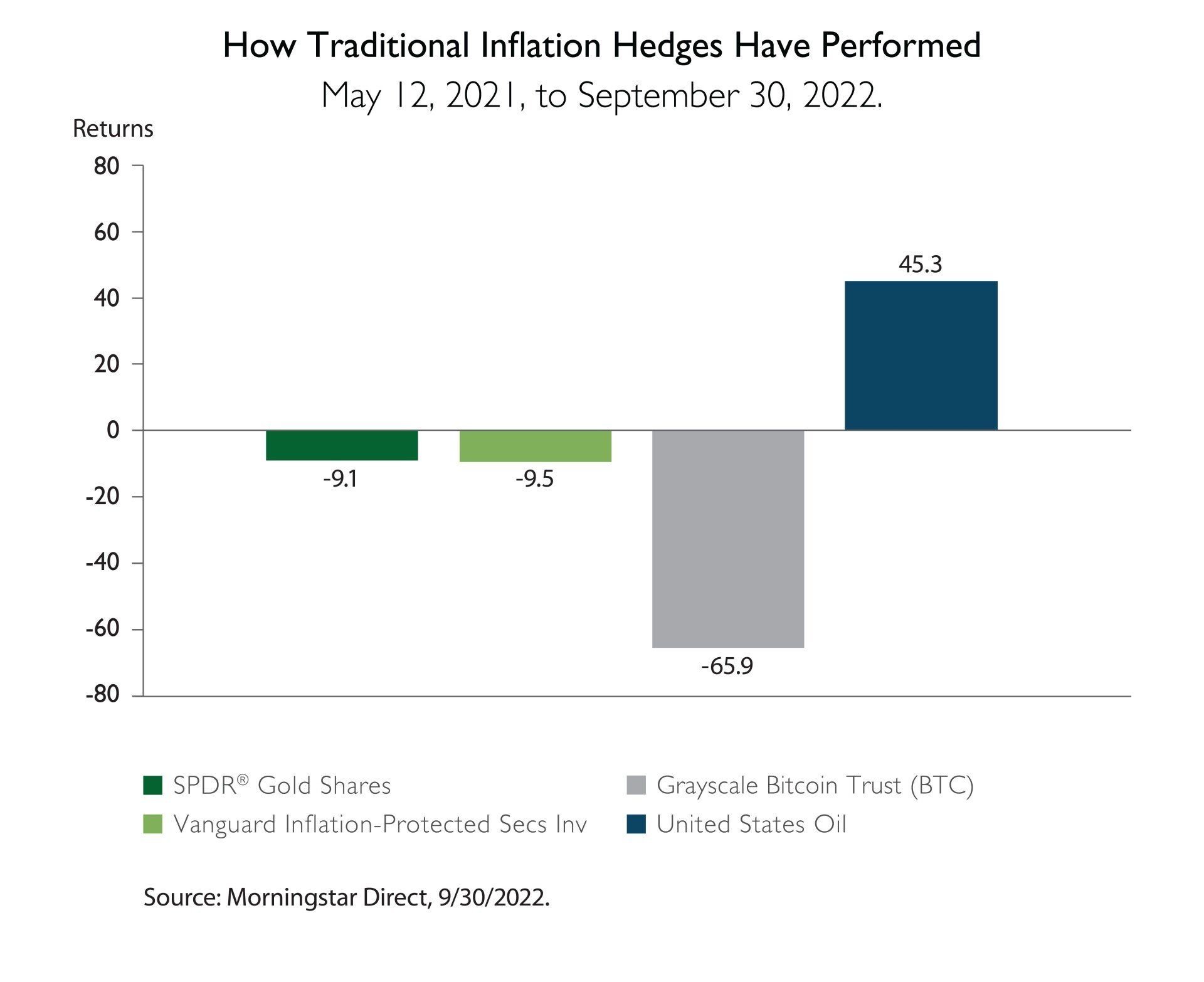

There is ongoing debate as to the efficacy of certain asset classes in different inflation environments. Below are four of the more popular ones:

- TIPS - U.S. Treasury Inflation-Protected Securities (TIPS) historically are viewed by investors to protect against higher inflation. Although they have outperformed the U.S. Treasury Bond Index, the performance has disappointed relative to the inflation rate surprises.

- Gold - had been underperforming broader asset classes coming into 2022, even though inflation numbers were coming in higher than expected. More recently, however, investors have flocked to gold and prices have started to climb. This has largely been due to the volatility created by the Russian invasion of Ukraine, which has investors going into the safety of gold rather than being driven by inflation worries.

- Energy - has often been described as an inflation hedge due to its short shelf life and its correlation to economic growth. Our main contention with energy as an asset class (and specifically oil and gas, which by market cap make up the largest part of the energy market), is their price volatility that will often be tied to demand-supply imbalances and the longer-term transition to greener alternative energy. In the past six months, we’ve seen oil and gasoline prices surge due to the demand-supply imbalance created by the war in Ukraine, particularly in light of sanctions on Russia. While prices have more recently moderated, what remains is structural underinvestment in refineries as well as oil drilling and exploration.

- Cryptocurrencies – Bitcoin, and other cryptocurrencies, have been described as “digital gold.” While there are some aspects of crypto that might mimic gold’s characteristics, namely its fixed supply and the need to (digitally) mine the asset, current price action has shown that it has been a poor “risk off” hedge. It has not held its value when inflation has gone up and has proven to be highly correlated to the equity markets.

Below are the returns for the various inflation hedges since May 12, 2021, when U.S. inflation first spiked, to Sep 30, 2022.

As we can see from the chart, apart from oil, traditional inflation hedges have not kept up with inflation. Oil has outperformed with a return of 45%, while Gold, TIPS, and Bitcoin have returned -9.1%, -9.5%, and -65.9%, respectively, badly underperforming the 8.2% inflation number as of September this year.

The takeaway from this analysis is the importance of diversifying across the various hedges for inflation. In this example, oil has proven to be the protector. Next time, it may be another asset class that comes to the rescue, illustrating why diversification is key.

What we are doing across our portfolios

At IPC, the Portfolio Management team is constantly thinking about how we can protect our clients’ money across the various business cycles. Accordingly, we’ve been busy incorporating several investment strategies across our portfolios to help cope with high inflation.

- Rotation towards the “defensive” or value-oriented section of the market as these sectors tend to do well in a rising rate environment.

- Investing in quality dividend-paying companies that are mature and tend to have pricing power where they can pass on some of the inflation expense to the consumer. Dividend-paying stocks tend to benefit from an inflationary environment since they tend to have capital discipline and don’t want to get penalized for missing a dividend payment.

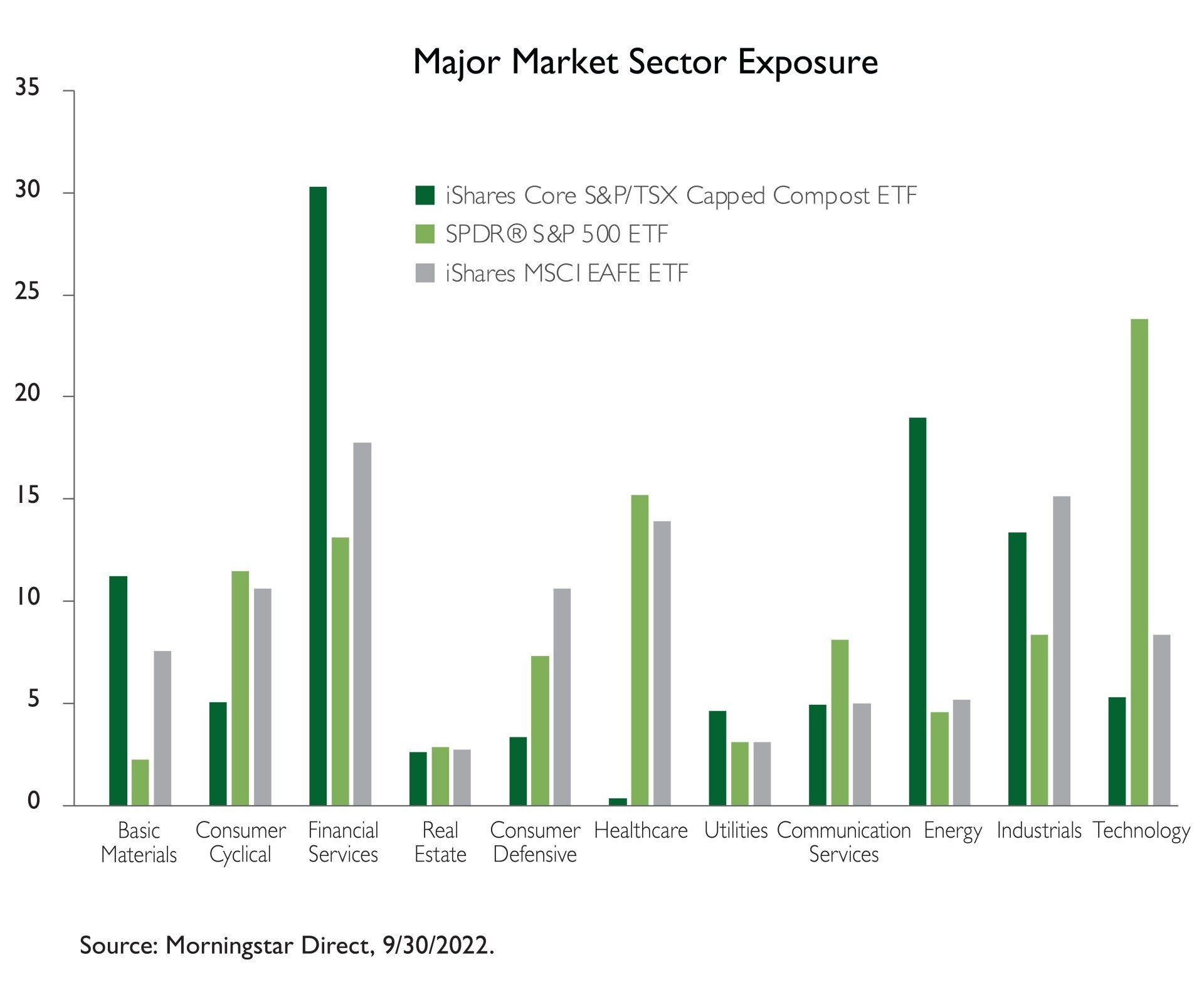

- Diversifying geographically since various regions have vastly different sector weightings, meaning they will behave differently in an inflationary or rising rate environment. In the chart below, we compare Canada, U.S., and International (EAFE) market sector weightings:

For example, Canada has higher weighting in Financials, Energy, Materials, and Industrials while the U.S. market is skewed towards Technology, Health Care and Consumer Discretionary. The international market is relatively more even in terms of its sector diversification but is still tilted towards cyclical stocks like Financials, Materials and Industrials. As mentioned previously, an allocation towards more defensive or cyclical sectors tends to benefit investors during an inflationary period.

In our portfolios we have done the following recently:

- Reduced our overweight to equities and slightly increased the weight towards fixed income

- Within fixed income, we reduced our overweight to high yield and global bonds and reallocated these positions towards Canadian Core Fixed Income.

- Within our equity allocation, we are maintaining an equal weight between our growth and value-oriented managers while complementing them with multifactor strategies. We have also reduced our allocation to Global Real Estate and Global Small Cap.

- Geographically, we have increased our U.S. equities exposure, and reduced our exposure to international equities, reallocating towards Canadian equities.

- Maintaining a largely unhedged position against U.S. dollar exposure in the portfolios and underlying funds as the USD has strengthened considerably against most currencies. Being unhedged during periods of USD strength/Canadian dollar weakness boosts the performance of USD-denominated securities.

In Conclusion

We find that the best hedge against inflation is to be diversified since there is no one magic bullet we can turn to with complete confidence. Rather than going all in on a specific strategy, we believe that providing exposure to multiple strategies will help ensure our clients can participate when the markets return to a more stable phase marked by a return to growth.

Investment Planning Counsel